The Local Government System (LGA) in Ghana is premised on the idea that Metropolitan, Municipal and District Assemblies (MMDAs) acting as rating authorities at the grassroots level should be able to independently mobilise revenue to finance most of their developmental projects. As rating authorities, MMDAs have the legal mandate to collect revenues in the form of taxes, user fees and licenses on physical properties and economic activities within their jurisdictions. These revenues constitute what is generally known as the Internal Generated Funds (IGFs). Property tax which is a legal fee levied on properties for which property owners are obliged to pay is widely viewed as one of the most significant and potential sources of revenue to MMDAs in Ghana.

Problems confronting Municipal and District Assemblies

Although property tax remains a potential source of revenue to MMDAs in Ghana, most MMDAs are fronted with numerous challenges when it comes to its mobilisation. One of such challenges is the inability of MMDAs to accurately assess their property tax base to know their expected revenue. In fact, without adequate information on the number of properties, the types (single storey, multiple storey), their uses (commercial, residential, civic and culture) as baseline data for the assessment, MMDAs cannot accurately calculate their tax base. Currently, the methods being used are time consuming and cost ineffective.

Drone photogrammetry and property tax evaluation

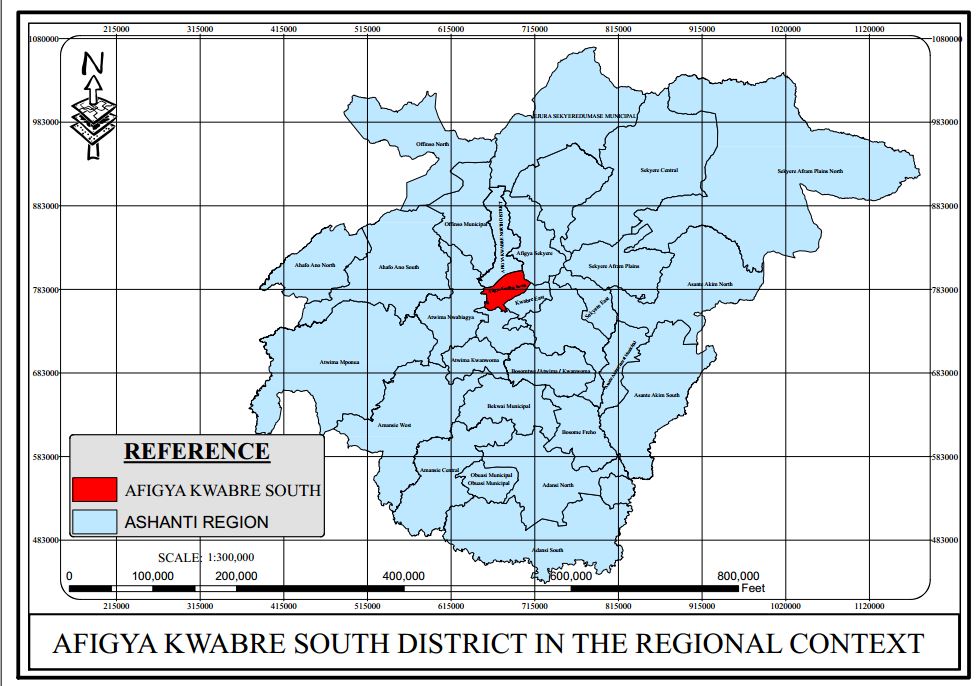

Therefore, Ziongate Geospatial and Research Services Ltd. (ZGRS) embarked on this project as a Proof of Concept (POC) to demonstrate to Afigya Kwabre South District Assembly (AKSDA) in the Ashanti Region of Ghana on how UAV photogrammetry combined with Geographic Information System can be used in building an effective database for property tax base assessment. The main focus of this exercise was to basically determine the number of physical properties and calculate tax -base based on existing rate and compare it with the annual property tax collected in the whole district. Atimatim which is one of the 57 communities in the district was selected for piloting.

Profile of pilot district

Afigya Kwabre South District Assembly (AKSDA) is one of the Local Government Areas within Ashanti regions of Ghana with a total area of about 138 square kilometers. Its central location within the Ashanti region and closeness to Kumasi, the second largest city in Ghana, makes it a dormitory district. As a result of high population growth in the district and its closeness to Kumasi, towns such as Atimatim, Maase, Kodie and Afrancho are gaining an urban status. Therefore, there is a potential for increased properties and rising property values in these areas.

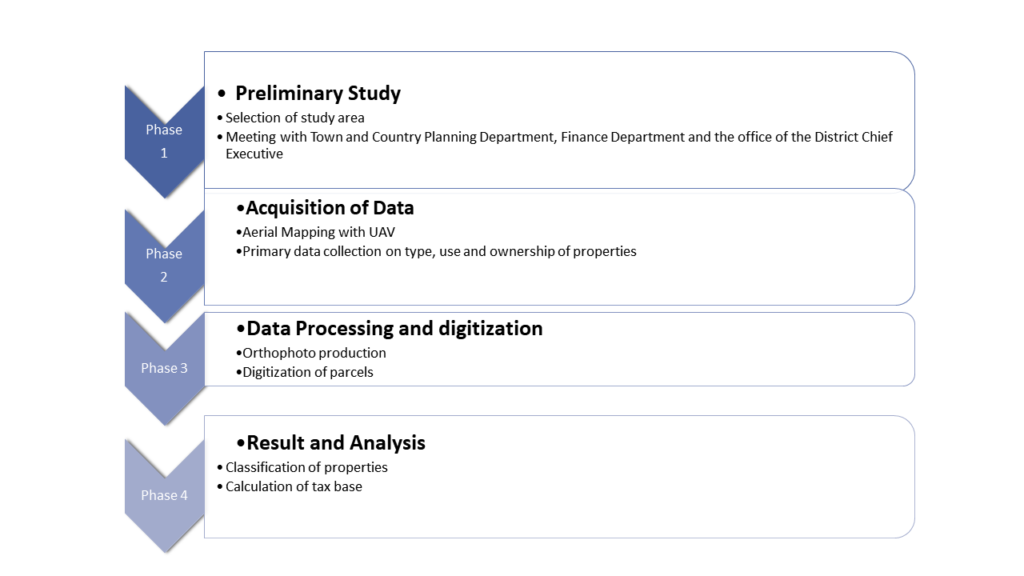

Methodology

In Phase 1: Preliminary study was undertaken to gather information on the existing approach for calculating tax base, the criteria for rating properties and the total amount of property tax collected in the previous year (2019).

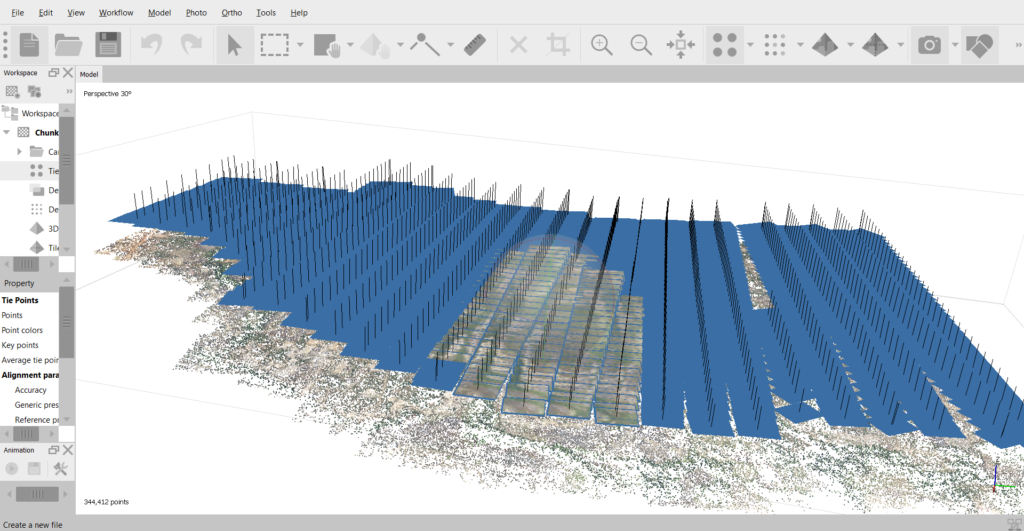

Phase 2: With the aid of drone photogrammetry an orthophoto showing all properties in Atimatim was produced. We used our drone (DJI Matrice 210 RTK and Phantom 4) to fly over the area at an elevation of 200 meters. Then we used photogrammetry techniques in the Agisoft software environment to perform interior and exterior orientation, triangulation and orthophoto generation.

using the software Agisoft Metashape Professional

Phase 3: The orthophoto image of the piloted area was imported into the ArcGIS software for visualisation and digitisation. Properties (Parcels) were digitised as seen in the drone raster image without making any distinction between residential and commercial properties considering the time available.

Findings

Property valuation and tax collection

Valuation of building or property is the method of calculating the present marketable cost of a building. This depends on several factors such as the type of structure, location, size and the type of use it is put to among many others. In Ghana, properties are mostly rated on the basis of the value of the building (number of rooms if residential).

In Afigya Kwabre South District Assembly (AKSDA), the annual fee fixing rate per room for a property that serves residential purpose is GH 30 ($ 6). Depending on the number of rooms in a particular property the annual tax on the property will be calculated as

Number of rooms per building x fee fixing rate = No. Rooms x GH 30.

For commercial properties, the annual rate per room space in the property is equivalent to GH 50. Thus, for a commercial property with 5 room spaces, the tax rate will be calculated as

Commercial Tax Rate = No. of room space x GH 50

= 5 x 50

= GH 250 cedis = $ 47

From the preliminary study ZGRS identified that the total property tax collected in the District (57 communities) for the fiscal year 2019 was equivalent to GH 150, 000 cedis = $ 27,777.78. We also identified that the total number of properties within the districts is not known.

Mapping

Total area covered during mapping was approximately 7 sq. km.

Images acquired = 600

Total flight duration was 2 hours

Total time taken to process the image = 6 hours

About 3200 parcels with either residential or commercial properties situated on were identified in the piloted area.

Determination of property tax base

We assumed that if there is an annual flat fee of GH 30 cedis to be paid by property owners irrespective of the type of economic or social use these properties have been put to and the rooms available, then the expected property tax base for Atimatim can be calculated as

Total No. of Parcels x the annual flat fee

= 3200 x GH 30 cedis

= GH 96,000 cedis

= $ 16, 608.35

This constitute almost 64 % of the total property tax collected in the district for the fiscal year 2019. However, should the type of use (commercial or residential) of each property in Atimatim and the number of available rooms within each property be taken into consideration, since each property will have it own applicable rate or tax , then property tax base of Atimatim will far exceed the revenue ($ 27,777.78) collected in the entire district for the fiscal year 2019

It is clear from the analysis above that there is a huge potential for Afigya Kwabre South District Assembly to increase it property tax revenue. With over 57 communities of the same status as Atimatim, their property tax base far exceeds $ 27,777.78

Impact of our Drone Photogrammetry and Geographic Information System for Property Tax Base Assessment

- Quick: The first key metric to understand the impact of our approach is that it is quick and efficient compared to traditional or conventional property mapping and digitisation. Valuation officers often spend several months to be able to account for properties within a 7sq.km area

- Availability of digitised data: Additionally, because data derived from this exercise is mostly in digitised format, it can be used in new areas of application. For example, the orthophoto can be used by the Town and Country Planning for development control and street naming and property addressing exercise.

- Bundle of data: With just a single flight comes several data orthomosaic, point cloud, DTM, DSM, contour lines, etc. It is difficult and cost ineffective using conventional or traditional method to acquire this data

- Access to inaccessible areas: Drone can go where no man can go. In most cases, properties in inaccessible areas are not accounted for under conventional method. An aerial mapping drone can fly almost anywhere.

Our proof of concept was accepted by Afigya Kwabre District Assembly and currently we are mapping the entire 57 communities.

About the Author:

Justice Kwame Gyesi

Director

Ziongate Geospatial and Research Services Ltd.

c/o Department of Planning

Kwame Nkrumah University of Science and Technology (KNUST)

PMB University Post office|

Kumasi

Ghana

Email: info@ziongategeospatial.com

Phone: +233 540298632

www.ziongategeospatial.com